TJ's Blog

Search results for 'guide' returned 31 results: Main Blog

Posted by TJ on Friday December 7, 2018 @ 12:56 PM

[Tags: tips, windows, guide]

My go to program to open any file that is unrecognizable in Windows is notepad. If the file happens to contain any readable text then you can at least get an idea what the file is.

To open any Windows file in notepad you can

1) right click the file

2) Choose "Open With"

3) and click Notepad (or browse for "notepad.exe")

4) Make sure to uncheck "Always use the selected program to open this kind of file" if you do not want this program to become program to open any file with the same file type.

However if you forget to deselect the option "Always use the selected program to open this kind of file" (as I often do) then Notepad will ever be associated with any file of the same type of file extension.

Windows 7 does not have any easy way to delete a file association once you set one up (you can only change it to a different program), however the below workaround should resolve the issue:

[Tags: tips, windows, guide]

My go to program to open any file that is unrecognizable in Windows is notepad. If the file happens to contain any readable text then you can at least get an idea what the file is.

To open any Windows file in notepad you can

1) right click the file

2) Choose "Open With"

3) and click Notepad (or browse for "notepad.exe")

4) Make sure to uncheck "Always use the selected program to open this kind of file" if you do not want this program to become program to open any file with the same file type.

However if you forget to deselect the option "Always use the selected program to open this kind of file" (as I often do) then Notepad will ever be associated with any file of the same type of file extension.

Windows 7 does not have any easy way to delete a file association once you set one up (you can only change it to a different program), however the below workaround should resolve the issue:

- Right click on your desktop, select new->new text document

- Rename the text document to "test.exe".

- Locate in explorer file you need to remove the file association for and right click on the file and choose "open with" and select "Choose default program".

- Now, you will get a list of program to choose from, click on "Browse.." at the bottom of the list.

- Navigate to desktop and choose "test.exe".

- Now, the file files would be associated with the "test.exe" program.

- Delete the "test.exe" file you created in the desktop. Now, the file should not be associated with any program.

Posted by TJ on Wednesday December 5, 2018 @ 03:05 PM

[Tags: guide, business, events]

USPS Holidays - 2019

Tuesday, January 1 - New Year's Day

Monday,January 21 - Martin Luther King Jr. birthday

Monday,February 18 - Washington's birthday

Monday,May 27 - Memorial Day

Thursday, July 4 - Independence Day

Monday,September 2 - Labor Day

Monday,October 14 - Columbus Day

Monday,November 11 - Veterans' Day

Thursday November 28 - Thanksgiving Day

Wednesday, December 25 - Christmas Day

USPS Holidays - 2020

Wednesday, January 1 - New Year's Day

Monday, January 20 - Martin Luther King Jr. birthday

Monday, February 17 - Washington's birthday

Monday, May 25 - Memorial Day

Friday, July 3 - Independence Day

Monday, September 7 - Labor Day

Monday, October 12 - Columbus Day

Wednesday, November 11 - Veterans' Day

Thursday November 26 - Thanksgiving Day

Friday, December 25 - Christmas Day

[Tags: guide, business, events]

USPS Holidays - 2019

Tuesday, January 1 - New Year's Day

Monday,January 21 - Martin Luther King Jr. birthday

Monday,February 18 - Washington's birthday

Monday,May 27 - Memorial Day

Thursday, July 4 - Independence Day

Monday,September 2 - Labor Day

Monday,October 14 - Columbus Day

Monday,November 11 - Veterans' Day

Thursday November 28 - Thanksgiving Day

Wednesday, December 25 - Christmas Day

USPS Holidays - 2020

Wednesday, January 1 - New Year's Day

Monday, January 20 - Martin Luther King Jr. birthday

Monday, February 17 - Washington's birthday

Monday, May 25 - Memorial Day

Friday, July 3 - Independence Day

Monday, September 7 - Labor Day

Monday, October 12 - Columbus Day

Wednesday, November 11 - Veterans' Day

Thursday November 26 - Thanksgiving Day

Friday, December 25 - Christmas Day

Posted by TJ on Friday December 14, 2012 @ 01:53 AM

[Tags: guide, business, events]

Below is a list of Federal USPS Holidays for 2013. Note that Tjshome.com will still be open for business on these dates :)

Read More...

[Tags: guide, business, events]

Below is a list of Federal USPS Holidays for 2013. Note that Tjshome.com will still be open for business on these dates :)

Read More...

Posted by TJ on Friday March 25, 2011 @ 06:44 PM

[Tags: guide, excel, accounting]

One my excel nuisances is spreadsheets that link to other external documents. If you plan on sending a file out, I feel that external links, should be avoided at all costs in the professional environment. External links may seem to work fine when the files are all your computer but once you give that file to another party it creates issues because excel can no longer find the file. Also changing the source document after you link to it also can create more issues.

So having said that, here are useful tips for finding and removing external links.

1) The easiest way to remove links in excel is using the "Edit Link" option on the Data ribbon. Here excel will list all the external documents that a spreadsheet is linking to. You can select each file listed then click "break links" and excel will replace the formulas that contain external links with values. The problem with this feature is you will not always know which formulas you are editing and the feature does not work on some links.

2) If you want to view each external link before editing it another option is to search for all external links. This can be achieved by using the "Find and Select" option on the Home ribbon. If you click the "option" button you can select to search the worksheet or the whole workbook. Now in the "find what" box type "[" or ".xls" without quotes.

3) Now if you tried the above and you still have external links this may be due to defined names that exist in workbook. You can see if you have defined names by clicking the "Name Manager" on the Formulas ribbon. Delete any names here that have errors or that are linking to external sources (make sure you correct any of the formulas using these names first, of course).

4) If you still can't find a link there is a handy tool created by Bill Manville that will find all hidden links and give you the option to delete each. You can download the file here: http://www.oaltd.co.uk/MVP/Default.htm

[Tags: guide, excel, accounting]

One my excel nuisances is spreadsheets that link to other external documents. If you plan on sending a file out, I feel that external links, should be avoided at all costs in the professional environment. External links may seem to work fine when the files are all your computer but once you give that file to another party it creates issues because excel can no longer find the file. Also changing the source document after you link to it also can create more issues.

So having said that, here are useful tips for finding and removing external links.

1) The easiest way to remove links in excel is using the "Edit Link" option on the Data ribbon. Here excel will list all the external documents that a spreadsheet is linking to. You can select each file listed then click "break links" and excel will replace the formulas that contain external links with values. The problem with this feature is you will not always know which formulas you are editing and the feature does not work on some links.

2) If you want to view each external link before editing it another option is to search for all external links. This can be achieved by using the "Find and Select" option on the Home ribbon. If you click the "option" button you can select to search the worksheet or the whole workbook. Now in the "find what" box type "[" or ".xls" without quotes.

3) Now if you tried the above and you still have external links this may be due to defined names that exist in workbook. You can see if you have defined names by clicking the "Name Manager" on the Formulas ribbon. Delete any names here that have errors or that are linking to external sources (make sure you correct any of the formulas using these names first, of course).

4) If you still can't find a link there is a handy tool created by Bill Manville that will find all hidden links and give you the option to delete each. You can download the file here: http://www.oaltd.co.uk/MVP/Default.htm

Posted by TJ on Saturday November 20, 2010 @ 04:24 PM

[Tags: scam, internet, guide]

There has been recent influx in cell phone text scams. These scams are an attempt to steal personal banking information or credit card information. The text message I received was from 917-822-2827 with text text "J P Morgan THPV alert". Please call 817685077".

Why is this a scam?

[Tags: scam, internet, guide]

There has been recent influx in cell phone text scams. These scams are an attempt to steal personal banking information or credit card information. The text message I received was from 917-822-2827 with text text "J P Morgan THPV alert". Please call 817685077".

Why is this a scam?

- I don't do banking with JP Morgan

- Banks don't normally text you when there is an issue with your bank

- The text is from an unverified number

- The text is vague and does not provide identifying information.

- An internet lookup/google search for the telephone number terms up no link to JP Morgan

Posted by TJ on Monday October 4, 2010 @ 01:44 PM

[Tags: internet, guide, email]

As widely discussed Google's Gmail platform has a neat little feature to undo a sent email if you want to recall within 30 seconds. The workings behind this feature is pretty simple. Google's server waits 30 seconds and only if the user doesn't click "undo" will it then send the email. No other platform that I am aware has this ability to do this. However, in most email software (including outlook) you can enable "automatic spell checking for every email" which adds an extra step to the sending process and gives you an extra time to ensure that each sent email is really what you want to send.

To enable auto spell check in outlook:

1) From the menu select Tools->Options

2) Select the spelling tab

3) Make sure "always check spelling before sending" is checked

Now this will only stop an email from being sent if any word is spelt wrong. To make sure every message requires an extra review add/modify a signature to your account under "Mail Format" and add an abbreviation (or your last name may work) that is not in the default dictionary such a Tel., thnx, etc.

[Tags: internet, guide, email]

As widely discussed Google's Gmail platform has a neat little feature to undo a sent email if you want to recall within 30 seconds. The workings behind this feature is pretty simple. Google's server waits 30 seconds and only if the user doesn't click "undo" will it then send the email. No other platform that I am aware has this ability to do this. However, in most email software (including outlook) you can enable "automatic spell checking for every email" which adds an extra step to the sending process and gives you an extra time to ensure that each sent email is really what you want to send.

To enable auto spell check in outlook:

1) From the menu select Tools->Options

2) Select the spelling tab

3) Make sure "always check spelling before sending" is checked

Now this will only stop an email from being sent if any word is spelt wrong. To make sure every message requires an extra review add/modify a signature to your account under "Mail Format" and add an abbreviation (or your last name may work) that is not in the default dictionary such a Tel., thnx, etc.

Posted by TJ on Sunday June 27, 2010 @ 03:45 PM

[Tags: guide, business, internet]

1) Google Maps - Add your shop to Google Maps. This is free and it will help users find your store when they are looking for store's near them. This is completely free service and should be a no-brainer for any store owner. link: http://www.google.com/local/add/analyticsSplashPage?hl=en&gl=us

2)Facebook fan page - This enables customers to "like" your store which adds a link to your store in your customers profile. This is great way to get referrals from you happiest customers. It also gives you an easy way to post news and updates on your store. This is completely free and easy to setup. All you need is a facebook account to link your page to.

link: http://www.facebook.com/advertising/?pages

3) Domain name and email address: Don't use free email address providers or your ISP provided email address for your business (IE: @gmail.com @verizon.net, or @msn.com). For $10/year you can register your own .com domain and get a personalized domain for your business and have a more professional and more trusted address (ie: yourname@yourbusinessname.com). Once you registered a domain you can get free email forwarding from zoneedit.com/. This will forward emails sent to your domain to your existing personal email account. Link:Godaddy.com

4) Simple Webpage - You should have at least a simple web listing. At the very least your webpage should include your address, brief description of products or services, hours, and phone number.

5) Yellow Page Listings - Add a free business listing to superpages.com and yellowpages.com. These are the two most popular online yellow page directories. You can add a free listings to both of these: supermedia.com/ and http://yellowpages.com/.

[Tags: guide, business, internet]

1) Google Maps - Add your shop to Google Maps. This is free and it will help users find your store when they are looking for store's near them. This is completely free service and should be a no-brainer for any store owner. link: http://www.google.com/local/add/analyticsSplashPage?hl=en&gl=us

2)Facebook fan page - This enables customers to "like" your store which adds a link to your store in your customers profile. This is great way to get referrals from you happiest customers. It also gives you an easy way to post news and updates on your store. This is completely free and easy to setup. All you need is a facebook account to link your page to.

link: http://www.facebook.com/advertising/?pages

3) Domain name and email address: Don't use free email address providers or your ISP provided email address for your business (IE: @gmail.com @verizon.net, or @msn.com). For $10/year you can register your own .com domain and get a personalized domain for your business and have a more professional and more trusted address (ie: yourname@yourbusinessname.com). Once you registered a domain you can get free email forwarding from zoneedit.com/. This will forward emails sent to your domain to your existing personal email account. Link:Godaddy.com

4) Simple Webpage - You should have at least a simple web listing. At the very least your webpage should include your address, brief description of products or services, hours, and phone number.

5) Yellow Page Listings - Add a free business listing to superpages.com and yellowpages.com. These are the two most popular online yellow page directories. You can add a free listings to both of these: supermedia.com/ and http://yellowpages.com/.

Posted by TJ on Monday April 5, 2010 @ 10:54 AM

[Tags: accounting, taxes, guide]

The table below summarizes the income limitations on Roth contributions for 2010

Read More...

[Tags: accounting, taxes, guide]

The table below summarizes the income limitations on Roth contributions for 2010

Read More...

Posted by TJ on Friday March 26, 2010 @ 12:38 PM

[Tags: guide, excel, accounting]

If you are trying to convert a Microsoft Excel 2007 file to open with Excel 2003 you may receive an error that there are "Too Many Cell Formats". After spending quite sometime I found a fix for this. You need to open the file in the Excel 2007 and run the macro below and then resave the file. Before you do anything make sure you save your file in case you don't like the results.

OPTION 1: The macro below will show a prompt "Delete Style ____" for each style which and you will need to click "YES" for each style. If you are not concerned about deleting a valid style you can use OPTION 2

OPTION 2:The macro below will delete all unused styles without a prompt. This is faster but can be more dangerous than OPTION 1. Make sure you save the file both before and after running the macro (thanks to Nick)

OPTION 3: For those that do not want to deal with Macro's there is a tool you can download that I also find very helpful and easy to use. The tool removes unused cell styles, "stubborn styles" that you can't delete through Excel UI, bad named ranges, named ranges with external references, and unhides non-system created hidden named ranges. Download XLCleaner here: https://skydrive.live.com/?cid=53e1d37f76f69444&id=53E1D37F76F69444!526&sc=documents

[Tags: guide, excel, accounting]

If you are trying to convert a Microsoft Excel 2007 file to open with Excel 2003 you may receive an error that there are "Too Many Cell Formats". After spending quite sometime I found a fix for this. You need to open the file in the Excel 2007 and run the macro below and then resave the file. Before you do anything make sure you save your file in case you don't like the results.

OPTION 1: The macro below will show a prompt "Delete Style ____" for each style which and you will need to click "YES" for each style. If you are not concerned about deleting a valid style you can use OPTION 2

Sub DeleteStyles()

'

' DeleteStyles Macro

'

Dim styT As Style

Dim intRet As Integer

For Each styT In ActiveWorkbook.Styles

If Not styT.BuiltIn Then

intRet = MsgBox("Delete style '" & styT.Name & "'?", vbYesNo)

If intRet = vbYes Then styT.Delete

End If

Next styT

End Sub

OPTION 2:The macro below will delete all unused styles without a prompt. This is faster but can be more dangerous than OPTION 1. Make sure you save the file both before and after running the macro (thanks to Nick)

Sub DeleteStyles()

'

' DeleteStyles Macro

'

Dim styT As Style

Dim intRet As Integer

For Each styT In ActiveWorkbook.Styles

If Not styT.BuiltIn Then

styT.Delete

End If

Next styT

End Sub

OPTION 3: For those that do not want to deal with Macro's there is a tool you can download that I also find very helpful and easy to use. The tool removes unused cell styles, "stubborn styles" that you can't delete through Excel UI, bad named ranges, named ranges with external references, and unhides non-system created hidden named ranges. Download XLCleaner here: https://skydrive.live.com/?cid=53e1d37f76f69444&id=53E1D37F76F69444!526&sc=documents

Posted by TJ on Monday July 27, 2009 @ 01:27 PM

[Tags: internet, guide, links]

If you want to be the gossip king/queen in your town their is several ways you can make sure you have the latest on what's happening around your town by using rss feeds:

If you don't currently use an rss reader checkout http://google.com/reader

[Tags: internet, guide, links]

If you want to be the gossip king/queen in your town their is several ways you can make sure you have the latest on what's happening around your town by using rss feeds:

If you don't currently use an rss reader checkout http://google.com/reader

- Twitter: Find out about what people are tweeting about around your town. With this feed you may get periodic traffic reports, restaurant reviews, odd events, and more. http://search.twitter.com/search.atom?q=%22Your%20Town.

- Trulia: Find out what houses are listed or selling around you:

http://www.google.com/reader/view/#stream/feed%2Fhttp%3A%2F%2Fwww.trulia.com%2Frss2%2Ffor_sale%2FYOUR ZIP CODE_zip%2FYOUR_STREET NAME_keyword%2F

(Replace Zip code and keywords (replace spaces with "_")

- Craigslist: Find out what others are selling in your town:

- Go to your local craigslist site.

- Enter your town in search bar ( Under the heading "Search Craigslist").

- Click the "RSS" logo in the bottom right of the search results for your local rss feed.

- Go to your local craigslist site.

- Local News:

Your local newspaper have a better feed available but otherwise use a topix.com feed to get your local news

http://www.topix.com/rss/city/[your-city]-[state abbreviation]

Replace [your-city] with name of your city (replacing spaces with "-") and [state abbreviation] with your two letter state code (IE: NY).

- Weather

Weatherbug.com offers free weather forecast subscriptions so you can get your daily forecast for your town sent to your reader.

Posted by TJ on Sunday July 26, 2009 @ 10:20 PM

[Tags: facebook, internet, guide]

Here is simple method of getting an rss script of all your friend's Facebook Status update. Once you get this link you can read your friends status in your favorite rss reader (google reader) without having to login to Facebook.

Update 06-28-11 The above instructions should be replaced with the following

[Tags: facebook, internet, guide]

Here is simple method of getting an rss script of all your friend's Facebook Status update. Once you get this link you can read your friends status in your favorite rss reader (google reader) without having to login to Facebook.

- While logged into facebook go to [[[no longer working. See new update below ]]]

- Click on "My Friends Notes" in the right column under "Subscribe to These Notes". The page that open should have an url something like:

http://www.facebook.com/feeds/friends_notes.php?id=12345678&key=123e4567d&format=rss20

- In the url address bar replace "friends_notes.php" with "friends_status.php"

- The finished url will be:

http://www.facebook.com/feeds/friends_status.php?id=12345678&key=123e4567d&format=rss20

with the id and key being unique to your account.

Update 06-28-11 The above instructions should be replaced with the following

- While logged into facebook go to this url: http://www.facebook.com/posted.php

- Under the heading Subscribe to Links right click on the link to "My Friends' Links" and copy the url. The "My Friends' Links" url under the "Browse Recent links" heading will not work. The url will be something like:

http://www.facebook.com/feeds/share_friends_notes.php?id=12345678&key=123e4567d&format=rss20

- In the url address bar replace "share_friends_notes.php" with "friends_status.php"

- The finished url will be:

http://www.facebook.com/feeds/friends_status.php?id=12345678&key=123e4567d&format=rss20

with the id and key being unique to your account.

Posted by TJ on Sunday May 17, 2009 @ 10:26 PM

[Tags: taxes, accounting, guide]

Obama issued the "Making Work Pay" tax credit for 2009 and 2010 tax payers as a form of stimulus which would increase the paychecks of workers through 2009 and 2010. You may of noticed that your paycheck has increased this year due to this credit. This credit could be headache for some filers come April 15th.

The credit changed the withholding tables that employers use to calculate your withholdings. Since your employer doesn't know your tax situation you should always keep an eye on your withholdings.

With the new credit the federal withholdings tables are adjusted so that if a single filer makes less than $75,000 his withholdings are lowered by $400 and a married filers withholdings are decreased by $600.

If you are single you will be able to claim the credit on your 2009 tax return for $400 (if you made less $75,000). If you are married you can claim a credit for $800 (if you made less than $150,000).

This could be lead to a problem in the following circumstances:

Note that this credit may also lead to additional late payment penalty if your withholdings are less than the tax due with your 2007 tax return. The IRS requires your withholdings (or estimated tax payments) to be 100% of the previous year tax liability or 90% of the current year tax due.

----------------

Circular 230 Disclaimer: Please be advised that, unless otherwise stated by the author, any tax advice contained in this message is not intended or written to be used, and cannot be used, by the recipient to avoid any federal tax penalty that may be imposed on the recipient.

[Tags: taxes, accounting, guide]

Obama issued the "Making Work Pay" tax credit for 2009 and 2010 tax payers as a form of stimulus which would increase the paychecks of workers through 2009 and 2010. You may of noticed that your paycheck has increased this year due to this credit. This credit could be headache for some filers come April 15th.

The credit changed the withholding tables that employers use to calculate your withholdings. Since your employer doesn't know your tax situation you should always keep an eye on your withholdings.

With the new credit the federal withholdings tables are adjusted so that if a single filer makes less than $75,000 his withholdings are lowered by $400 and a married filers withholdings are decreased by $600.

If you are single you will be able to claim the credit on your 2009 tax return for $400 (if you made less $75,000). If you are married you can claim a credit for $800 (if you made less than $150,000).

This could be lead to a problem in the following circumstances:

- You earn income from more than one job. Both employers will give you the withholding deduction when in reality you can only claim one credit, $400 if single, $800 if married.

- If you are married and both you and your spouse work you will each have received $600 more in 2009. However the credit is only $800 for a joint filer making your withholding's less than the tax anticipated.

- Over the limits -- The credit starts to phaseout at $75000 adjusted gross income for single filers ($150,000 for Joint filers). If you are over the limit you employer may still give you the credit if you are not over the limit for that one job leading to your withholdings being less than they usually would.

Note that this credit may also lead to additional late payment penalty if your withholdings are less than the tax due with your 2007 tax return. The IRS requires your withholdings (or estimated tax payments) to be 100% of the previous year tax liability or 90% of the current year tax due.

----------------

Circular 230 Disclaimer: Please be advised that, unless otherwise stated by the author, any tax advice contained in this message is not intended or written to be used, and cannot be used, by the recipient to avoid any federal tax penalty that may be imposed on the recipient.

Posted by TJ on Friday April 24, 2009 @ 01:08 PM

[Tags: accounting, guide, business]

Below is outline of the tests used to determine whether a lease should be accounted for as a Capital Lease or an Operating Lease for GAAP Accounting.

A lease should be treated as an capital lease if it meets any one of the following four conditions -

(a) If the lease life exceeds 75% of the life of the asset

(b) if there is a transfer of ownership to the lessee at the end of the lease term

(c) if there is an option to purchase the asset at a "bargain price" at the end of the lease term.

(d) if the present value of the lease payments, discounted at an appropriate discount rate, exceeds 90% of the fair market value of the asset.

Source: FASB Statement No. 13 - Accounting for Leases

(as replaced by Codification Topic 840 Leases)

[Tags: accounting, guide, business]

Below is outline of the tests used to determine whether a lease should be accounted for as a Capital Lease or an Operating Lease for GAAP Accounting.

A lease should be treated as an capital lease if it meets any one of the following four conditions -

(a) If the lease life exceeds 75% of the life of the asset

(b) if there is a transfer of ownership to the lessee at the end of the lease term

(c) if there is an option to purchase the asset at a "bargain price" at the end of the lease term.

(d) if the present value of the lease payments, discounted at an appropriate discount rate, exceeds 90% of the fair market value of the asset.

Source: FASB Statement No. 13 - Accounting for Leases

(as replaced by Codification Topic 840 Leases)

Posted by TJ on Monday April 13, 2009 @ 03:51 PM

[Tags: accounting, taxes, guide]

NYC Board of Education employees are not subject to Form 1127 (Sec. 1127)

I was looking this up for a client and confirmed on phone with NYC department of finance and on their website.

If you were a nonresident of the New York City while working for certain city agencies you are subject to

1127 of the New York City Charter

and must file Form NYC-1127

If you are subject to that law, you are required to pay to the City an amount by which a City personal income tax on residents, computed and determined as

if you were a resident of the City, exceeds the amount of any City tax liability computed and reported by you on the City portion of your New York State tax return.

source: http://www.nyc.gov/html/opa/html/faqs/tax_related_2.shtml

[Tags: accounting, taxes, guide]

NYC Board of Education employees are not subject to Form 1127 (Sec. 1127)

I was looking this up for a client and confirmed on phone with NYC department of finance and on their website.

If you were a nonresident of the New York City while working for certain city agencies you are subject to

1127 of the New York City Charter

and must file Form NYC-1127

If you are subject to that law, you are required to pay to the City an amount by which a City personal income tax on residents, computed and determined as

if you were a resident of the City, exceeds the amount of any City tax liability computed and reported by you on the City portion of your New York State tax return.

- Exemptions:

- Department of Education

- City University of New York

- District Attorneys Offices

- New York City Housing Authority.

Section 1127 of the New York City Charter does not apply to:

source: http://www.nyc.gov/html/opa/html/faqs/tax_related_2.shtml

Posted by TJ on Friday April 10, 2009 @ 11:54 AM

[Tags: guide, business, events]

2009 Postal Holidays

* Thursday, January 1 - New Year's Day

* Monday, January 19 - Martin Luther King Jr's Birthday

* Monday, February 16 - Washington's Birthday (President's Day)

* Monday, May 25 - Memorial Day

* Saturday, July 4 - Independence Day

* Monday, September 7 - Labor Day

* Monday, October 12 - Columbus Day

* Wednesday, November 11 - Veterans Day

* Thursday, November 26 - Thanksgiving Day

* Friday, December 25 - Christmas Day

* Friday, January 1, 2010 - New Year's Day

2010 USPS Holidays

* New Years Day Friday, January 1st

* Birthday of Martin Luther King Monday, January 18th

* George Washingtons Birthday (commonly known as Presidents Day) Monday, February 15th

* Memorial Day Monday, May 31st

* Independence Day Monday, July 5th 1

* Labor Day Monday, September 6th

* Columbus Day Monday, October 11th

* Veterans Day Thursday, November 11th

* Thanksgiving Day Thursday, November 25th

* Christmas Day Friday, December 24th 2

1 July 4, 2010 (the legal public holiday for Independence Day), falls on a Sunday. For most Federal employees including postal employees, Monday, July 5, will be treated as a holiday for pay and leave purposes. (See section 3(a) of Executive order 11582, February 11, 1971.)

2 December 25, 2010 (the legal public holiday for Christmas Day), falls on a Saturday. For most Federal employees, Friday, December 24, will be treated as a holiday for pay and leave purposes. (See 5 U.S.C. 6103(b).)

[Tags: guide, business, events]

2009 Postal Holidays

* Thursday, January 1 - New Year's Day

* Monday, January 19 - Martin Luther King Jr's Birthday

* Monday, February 16 - Washington's Birthday (President's Day)

* Monday, May 25 - Memorial Day

* Saturday, July 4 - Independence Day

* Monday, September 7 - Labor Day

* Monday, October 12 - Columbus Day

* Wednesday, November 11 - Veterans Day

* Thursday, November 26 - Thanksgiving Day

* Friday, December 25 - Christmas Day

* Friday, January 1, 2010 - New Year's Day

2010 USPS Holidays

* New Years Day Friday, January 1st

* Birthday of Martin Luther King Monday, January 18th

* George Washingtons Birthday (commonly known as Presidents Day) Monday, February 15th

* Memorial Day Monday, May 31st

* Independence Day Monday, July 5th 1

* Labor Day Monday, September 6th

* Columbus Day Monday, October 11th

* Veterans Day Thursday, November 11th

* Thanksgiving Day Thursday, November 25th

* Christmas Day Friday, December 24th 2

1 July 4, 2010 (the legal public holiday for Independence Day), falls on a Sunday. For most Federal employees including postal employees, Monday, July 5, will be treated as a holiday for pay and leave purposes. (See section 3(a) of Executive order 11582, February 11, 1971.)

2 December 25, 2010 (the legal public holiday for Christmas Day), falls on a Saturday. For most Federal employees, Friday, December 24, will be treated as a holiday for pay and leave purposes. (See 5 U.S.C. 6103(b).)

Posted by TJ on Tuesday March 31, 2009 @ 07:23 PM

[Tags: taxes, accounting, guide]

Elgible Insulated Garage Doors may qualify for a ta tax credit if installed in 2009 or 2010

The new American Recovery and Reinvestment Act of 2009 was signed by President Obama on Feb. 17, 2009, U.S.

Tax credits are available for qualifying garage door purchases placed in service from Jan. 1, 2009, to Dec. 31, 2010. The maximum tax credit a taxpayer may claim is 30 percent of the cost of each product and $1500 over the lifetime of the tax credit periods (2009 and 2010).

A qualifying garage door installation is all of the following:

* The door must be an insulated residential garage door, installed on an insulated garage.

* The door's U-factor must be less than or equal to 0.30, even if the door contains windows.

* The door perimeter must be able to control air infiltration.

* The door must be expected to remain in service for at least five years.

* The garage must be part of the taxpayer's principal U.S. residence.

As well as receiving the credit a new garage door can also significantly improve a curb appeal and value.

Other Federal Tax Credits for Energy Efficiency includes:

* Tax Credits for Consumers

o Tax credits are available at 30% of the cost, up to $1,500, in 2009 & 2010 (for existing homes only) for:

+ Windows and Doors

+ Insulation

+ Roofs (Metal and Asphalt)

+ HVAC

+ Water Heaters (non-solar)

+ Biomass Stoves

o Tax credits are available at 30% of the cost, with no upper limit through 2016 (for existing homes & new construction) for:

+ Geothermal Heat Pumps

+ Solar Panels

+ Solar Water Heaters

+ Small Wind Energy Systems

+ Fuel Cells

* Cars

* Tax Credits for Home Builders

* Tax Deductions for Commercial Buildings

* For More Information

As you may know, a tax credit is more advantageous than a tax deduction since it decreases your tax liability dollar for dollar, as opposed to a tax deduction which decreases your taxable income subject to tax.

Source: http://www.energystar.gov/index.cfm?c=products.pr_tax_credit

[Tags: taxes, accounting, guide]

Elgible Insulated Garage Doors may qualify for a ta tax credit if installed in 2009 or 2010

The new American Recovery and Reinvestment Act of 2009 was signed by President Obama on Feb. 17, 2009, U.S.

Tax credits are available for qualifying garage door purchases placed in service from Jan. 1, 2009, to Dec. 31, 2010. The maximum tax credit a taxpayer may claim is 30 percent of the cost of each product and $1500 over the lifetime of the tax credit periods (2009 and 2010).

A qualifying garage door installation is all of the following:

* The door must be an insulated residential garage door, installed on an insulated garage.

* The door's U-factor must be less than or equal to 0.30, even if the door contains windows.

* The door perimeter must be able to control air infiltration.

* The door must be expected to remain in service for at least five years.

* The garage must be part of the taxpayer's principal U.S. residence.

As well as receiving the credit a new garage door can also significantly improve a curb appeal and value.

Other Federal Tax Credits for Energy Efficiency includes:

* Tax Credits for Consumers

o Tax credits are available at 30% of the cost, up to $1,500, in 2009 & 2010 (for existing homes only) for:

+ Windows and Doors

+ Insulation

+ Roofs (Metal and Asphalt)

+ HVAC

+ Water Heaters (non-solar)

+ Biomass Stoves

o Tax credits are available at 30% of the cost, with no upper limit through 2016 (for existing homes & new construction) for:

+ Geothermal Heat Pumps

+ Solar Panels

+ Solar Water Heaters

+ Small Wind Energy Systems

+ Fuel Cells

* Cars

* Tax Credits for Home Builders

* Tax Deductions for Commercial Buildings

* For More Information

As you may know, a tax credit is more advantageous than a tax deduction since it decreases your tax liability dollar for dollar, as opposed to a tax deduction which decreases your taxable income subject to tax.

Source: http://www.energystar.gov/index.cfm?c=products.pr_tax_credit

Posted by TJ on Wednesday March 25, 2009 @ 04:25 PM

[Tags: taxes, accounting, guide]

Mortgage Interest Deduction

Most people are able to deduct fully the amount of mortgage interest paid during the year as an itemized deduction any mortgage paid during the tax year. Mortgage Interest is deducted on Lines 10-14 of Schedule A of Form 1040.

However, the deduction does have some limitations. The deduction is limited to mortgages you took out after October 13, 1987, to buy, build, or improve your home (called home acquisition debt). You also can only fully deduct mortgages that had balances totaling $1 million or less ($500,000 if married filing separately). If the balances on your mortgages totaled $1,000,000 million or more see the table below to see if you qualify for a partial deduction.

Read More...

[Tags: taxes, accounting, guide]

Mortgage Interest Deduction

Most people are able to deduct fully the amount of mortgage interest paid during the year as an itemized deduction any mortgage paid during the tax year. Mortgage Interest is deducted on Lines 10-14 of Schedule A of Form 1040.

However, the deduction does have some limitations. The deduction is limited to mortgages you took out after October 13, 1987, to buy, build, or improve your home (called home acquisition debt). You also can only fully deduct mortgages that had balances totaling $1 million or less ($500,000 if married filing separately). If the balances on your mortgages totaled $1,000,000 million or more see the table below to see if you qualify for a partial deduction.

Read More...

Posted by TJ on Wednesday February 4, 2009 @ 12:55 PM

[Tags: accounting, taxes, guide]

Here are tips to save time and money by preparing to meet with your CPA professional tax return accountant:

[Tags: accounting, taxes, guide]

Here are tips to save time and money by preparing to meet with your CPA professional tax return accountant:

- Take your documents out of envelopes - neatly organized files saves you time.

- If your going to new preparer bring copies of prior year return (fed and state)

- Unless you want to pay your preparer to sort, organize, and add up receipts. Have your receipts organized and totaled by category. Have other relevant documents organized by category.

- Provide relevant computer data files - If you track your finances with a program such as Quicken or Excel, bring the data file with you OR provide category reports to the accountant. He may see a deduction you missed or need additional information then. You also may want to provide a year end credit card statement for same reason.

- have SS#, birthdate, and names of all dependents

- Have your bank account information (routing# and account#) for direct deposit of refunds

- Have cost basis of any stocks sold

- Provide closing documents if you bought/sold home.

- A summary sheet with all information you are providing is always helpful but not necessary. This will make sure we don't miss anything.

Posted by TJ on Friday November 7, 2008 @ 02:02 PM

[Tags: guide, internet, craigslist]

Okay lets say you want to sell something on Craigslist. How about we say it's refrigerator.

A good description to sell this is not:

"White refrigerator for sale"

This is missing a lot of information and you are not going to get a lot of serious replies. You may also miss serious takers because they are not willing to email every ad asking for more details.

Here is some important information that should be included in every ad:

If you do not want to list all this information and the item is still for sale find the item on Amazon.com or other retailer and link to it.

If applicable:

Spend a little time on your advertisement and you will be surprised at the responses you receive.

[Tags: guide, internet, craigslist]

Okay lets say you want to sell something on Craigslist. How about we say it's refrigerator.

A good description to sell this is not:

"White refrigerator for sale"

This is missing a lot of information and you are not going to get a lot of serious replies. You may also miss serious takers because they are not willing to email every ad asking for more details.

Here is some important information that should be included in every ad:

- Brand

- Model #/Part #

- Photo ... if you do not have a digital camera find a stock picture of item off the internet... do a Google image search.

- Color

- Size

- Price

- Condition (good/decent/bad/like new)

- What is included? (list all separate items included/power cord/ice tray/)

If you do not want to list all this information and the item is still for sale find the item on Amazon.com or other retailer and link to it.

If applicable:

- List if the product Manual is included. If you don't have manual you can usually find the manual on manufacturers website. Find the manual and include link to it in your ad.

Spend a little time on your advertisement and you will be surprised at the responses you receive.

Posted by TJ on Monday October 27, 2008 @ 03:13 PM

[Tags: guide, business, economy]

US First Class Stamp: 44 cents

Effective May 12, 2008: the current price of a stamp is 44 cents. First-Class Mail Letter (1 oz.) is 44 cents. Each additional ounce costs 17 cents. Postcard stamps are now 28 cents.

Update: On May 11, a first-class stamp will go up by 2 cents to 44 cents. Other rates are set to rise as well. The updated prices are reflected above.

The post office adjusts rates each May, but any increases must be at or below the rate of inflation under a 2006 law.

http://www.post-gazette.com/pg/09101/962044-28.stm#ixzz0HxzFnoH3&D

Source: United States Postal Service (USPS.com)

The price of a stamp increased 1300% from the value of $.03. in 1917

However, this increase is in line with increases of other items as well....

a Dodge Sedan was $1,185 in 1917, that's also 1300% less than today

You could also could buy a pair of men's shoes for less than $6

And your local paper for $.01

Eggs were .39/dozen

A color TV cost.. oh wait a minute...

Okay now I will stop sounding like your grandpa.

1917 Prices from survey in Morris County, NJ

[Tags: guide, business, economy]

US First Class Stamp: 44 cents

Effective May 12, 2008: the current price of a stamp is 44 cents. First-Class Mail Letter (1 oz.) is 44 cents. Each additional ounce costs 17 cents. Postcard stamps are now 28 cents.

Update: On May 11, a first-class stamp will go up by 2 cents to 44 cents. Other rates are set to rise as well. The updated prices are reflected above.

The post office adjusts rates each May, but any increases must be at or below the rate of inflation under a 2006 law.

http://www.post-gazette.com/pg/09101/962044-28.stm#ixzz0HxzFnoH3&D

Source: United States Postal Service (USPS.com)

The price of a stamp increased 1300% from the value of $.03. in 1917

However, this increase is in line with increases of other items as well....

a Dodge Sedan was $1,185 in 1917, that's also 1300% less than today

You could also could buy a pair of men's shoes for less than $6

And your local paper for $.01

Eggs were .39/dozen

A color TV cost.. oh wait a minute...

Okay now I will stop sounding like your grandpa.

1917 Prices from survey in Morris County, NJ

Posted by TJ on Tuesday October 21, 2008 @ 12:44 PM

[Tags: guide, accounting, excel]

Let's see how this goes...

I am a CPA and use Microsoft Excel spreadsheet software everyday. Being advanced in Excel makes my job extremely easier. I figured I'd see if there is anyone out there who has quick questions in excel that I can help. Hey what can I say I'm a generous guy.

To ask your question, use the comments form below! I will post responses to your questions below. I do not answer replies through email, as posting the answer here will help others who may have the same question as you.

Ask away...

Note: Please provide enough information for me to be able answer your question (the more info the better). The more effort you put into your question the more effort I will put into my response.

[Tags: guide, accounting, excel]

Let's see how this goes...

I am a CPA and use Microsoft Excel spreadsheet software everyday. Being advanced in Excel makes my job extremely easier. I figured I'd see if there is anyone out there who has quick questions in excel that I can help. Hey what can I say I'm a generous guy.

To ask your question, use the comments form below! I will post responses to your questions below. I do not answer replies through email, as posting the answer here will help others who may have the same question as you.

Ask away...

Note: Please provide enough information for me to be able answer your question (the more info the better). The more effort you put into your question the more effort I will put into my response.

Posted by TJ on Wednesday July 23, 2008 @ 12:25 PM

[Tags: automobile, links, guide]

I am not currently in the market for a new car but if you are, here are two important websites you should checkout:

Fueleconomy.gov Compare the miles per gallon and annual fuel cost between models before making your decision which model you buy.

Edmunds This has everything from reviews to price quotes. I suggest you get a price quote for the model your interested in and bring this to dealer with you as it could be used in negotiations. Also determine the value of your used car before you trade it in.

[Tags: automobile, links, guide]

I am not currently in the market for a new car but if you are, here are two important websites you should checkout:

Fueleconomy.gov Compare the miles per gallon and annual fuel cost between models before making your decision which model you buy.

Edmunds This has everything from reviews to price quotes. I suggest you get a price quote for the model your interested in and bring this to dealer with you as it could be used in negotiations. Also determine the value of your used car before you trade it in.

Posted by TJ on Friday July 11, 2008 @ 02:25 PM

[Tags: guide, humor, bored]

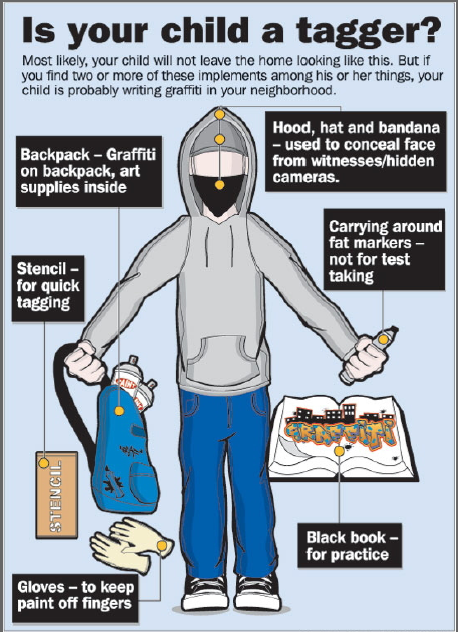

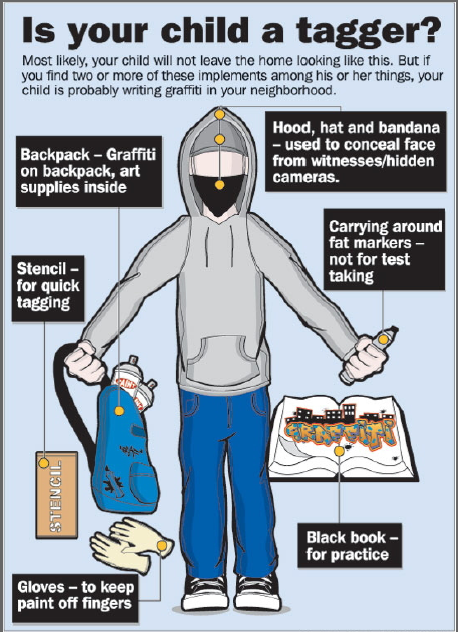

Is your son a tagger? I saw this while doing a Google Image Search. It comes from the website of the City of Santa Ana, California.

This is not only ridiculous because all of these points are obvious. If my child had any of these things it would lead to ask him "what the heck are you doing with that?

Source: http://www.ci.santa-ana.ca.us/pd/Graffiti.asp

[Tags: guide, humor, bored]

Is your son a tagger? I saw this while doing a Google Image Search. It comes from the website of the City of Santa Ana, California.

This is not only ridiculous because all of these points are obvious. If my child had any of these things it would lead to ask him "what the heck are you doing with that?

Source: http://www.ci.santa-ana.ca.us/pd/Graffiti.asp

Posted by TJ on Friday February 8, 2008 @ 05:25 PM

[Tags: accounting, taxes, guide]

Most people will be receiving a credit from the Government as they hope to stimulate the economy and reduce fears of recession. Will it work? Probably not, but that's a whole other story. Here is the lowdown on the credits.

When will I get the check?

If you are eligible you will most likely see your check in May or July.

Your credit is $600 if single and $1,200 combined if married. You also receive an additional $300 per child.

Calculating the credit

Add $600 - If you filed Form 1040 for the 2007 tax year

Add $600 - If your married

Add $300 - for each of you dependent children

Total = Your potential household refund (see partial refunds below)

To be fully eligle

Your 2007 adjusted gross income(AGI) has to be less than $75,000 single or $150,000 married. You can find your AGI by look on line 7 of Form 1040.

Partially elgible?

If your adjusted gross exceed 75,000(single) or 150,000 (married) you may still receive a partial refund.

Take your Adjusted Gross income from your 2007 1040, Line 37

Then subtract $75,000 if you filed single or $150,000 if you filed a joint return

Now multiply the result by 5%. This is the amount you reduce your credit by (see "calculating your credit above").

[Tags: accounting, taxes, guide]

Most people will be receiving a credit from the Government as they hope to stimulate the economy and reduce fears of recession. Will it work? Probably not, but that's a whole other story. Here is the lowdown on the credits.

When will I get the check?

If you are eligible you will most likely see your check in May or July.

Your credit is $600 if single and $1,200 combined if married. You also receive an additional $300 per child.

Calculating the credit

Add $600 - If you filed Form 1040 for the 2007 tax year

Add $600 - If your married

Add $300 - for each of you dependent children

Total = Your potential household refund (see partial refunds below)

To be fully eligle

Your 2007 adjusted gross income(AGI) has to be less than $75,000 single or $150,000 married. You can find your AGI by look on line 7 of Form 1040.

Partially elgible?

If your adjusted gross exceed 75,000(single) or 150,000 (married) you may still receive a partial refund.

Take your Adjusted Gross income from your 2007 1040, Line 37

Then subtract $75,000 if you filed single or $150,000 if you filed a joint return

Now multiply the result by 5%. This is the amount you reduce your credit by (see "calculating your credit above").

Posted by Tj on Tuesday January 15, 2008 @ 05:32 PM

[Tags: politics, links, guide]

You can't complain at the president if you don't do your part in selecting the right one!

To register: Use the link below and select your state and fill in web form. It will generate a customized PDF which contains your registration form. Print it and follow the directions to sign, fold, put on a stamp and mail it in. Include a photocopy of your identification (a drivers license or US passport) with it if you can. You can without sending in a copy of your ID, but you will have to show ID when you vote the first time (bring your ID to the polls regardless, just in case). You should get a conformation mailing back from your state.

To Register:

http://www.registrationbyworkingassets.com/register/

Who can Register?

In Idaho, Minnesota, New Hampshire, Wisconsin and Wyoming you may register to vote at your polling place on election day.

In Maine, you can register up to and on election day in person at your town office or city hall

North Dakota does not have voter registration. If you do not have a government issued ID, call your states election office

You can register to vote online in WA and AZ - You won't even need to leave the confines of you computer chair to place your vote:

Washington State:

http://secstate.wa.gov/elections/register.aspx

For Arizona State:

http://www.azsos.gov/election/VoterRegistration.htm

[Tags: politics, links, guide]

You can't complain at the president if you don't do your part in selecting the right one!

To register: Use the link below and select your state and fill in web form. It will generate a customized PDF which contains your registration form. Print it and follow the directions to sign, fold, put on a stamp and mail it in. Include a photocopy of your identification (a drivers license or US passport) with it if you can. You can without sending in a copy of your ID, but you will have to show ID when you vote the first time (bring your ID to the polls regardless, just in case). You should get a conformation mailing back from your state.

To Register:

http://www.registrationbyworkingassets.com/register/

Who can Register?

- A United States citizen

- At least 18 years old at time of election

- A resident of state you are registering in

- Any one who meets the requirements above

- Any one who moved or changed their address and did not register

In Idaho, Minnesota, New Hampshire, Wisconsin and Wyoming you may register to vote at your polling place on election day.

In Maine, you can register up to and on election day in person at your town office or city hall

North Dakota does not have voter registration. If you do not have a government issued ID, call your states election office

You can register to vote online in WA and AZ - You won't even need to leave the confines of you computer chair to place your vote:

Washington State:

http://secstate.wa.gov/elections/register.aspx

For Arizona State:

http://www.azsos.gov/election/VoterRegistration.htm

Posted by TJ on Monday October 22, 2007 @ 03:38 PM

[Tags: internet, guide, google]

I wrote this article years ago but am reposting it here so it will have perpetual life...

Google 101 - Brief Intro to the Google Search Engine

Disclaimer: Tjshome.com is not affiliated or endorsed by Google.

Google is a trademark of Google Inc. .

[Tags: internet, guide, google]

I wrote this article years ago but am reposting it here so it will have perpetual life...

Google 101 - Brief Intro to the Google Search Engine

| The Logo: You may notice a different logo on some day's, and this because they create a new logo for every holiday. See Past logo's |

| Google Images is an awesome tool. Need a picture of a "guy with a fro"? Type that into the the search bar then hit the images tab to get one. |

| Google Video: Search through 1000's of TV programs and web videos or share your own videos with the world. |

| Google News: This is another feature I use almost every day. Search thousands of current and past news stories. Search for your hometown to see your local news. |

| Google Maps: View maps, satelite photos, or get directions and never get lost again |

| More: Books (Search through hundreds of published books), Froogle (Shop for the best prices), Groups (search Usenet posts) |

| Advanced Search: Pretty self explanatory. You may want to use this feature to narrow the results of a basic search. Check it out |

| Preferences: Choose your default language, select to filter out explicit results, and select how many results google shows per page. Google remembers these settings Check it out |

| Language Tools: Translate whole pages to another language. Search for pages in specific languages. View this page in German |

| I'm Feeling Lucky: This is for when your search terms are precise, you can hit this button and Google will forward you to the one site that best fits your search terms. |

| Services & Tools: Check out other cool features |

Disclaimer: Tjshome.com is not affiliated or endorsed by Google.

Google is a trademark of Google Inc. .

Posted by TJ on Friday October 12, 2007 @ 08:08 PM

[Tags: hints, guide, trends]

I don't really goto Halloween parties but I came up with this list in case I did...

2007 Original Halloween Costume Ideas

Amy Winehouse.

Ipod Guy Siloutte (from the commercials)

Geico Caveman

Claw machine (with stuffed animals)

Bob Barker

Indiana Jones

Chris Hansen (from to catch a predator)

Old Classics:

Where's Waldo

Tetris Pieces (works good for couple's)

Weekend at Bernie's

Michelin Man

Stupid Boring Gimmicks:

Baby

Hooker

Pimp

Doctor

Vampire

Witch

Crazy scientist

Pirate (jack sparrow)

Convict

[Tags: hints, guide, trends]

I don't really goto Halloween parties but I came up with this list in case I did...

2007 Original Halloween Costume Ideas

Amy Winehouse.

Ipod Guy Siloutte (from the commercials)

Geico Caveman

Claw machine (with stuffed animals)

Bob Barker

Indiana Jones

Chris Hansen (from to catch a predator)

Old Classics:

Where's Waldo

Tetris Pieces (works good for couple's)

Weekend at Bernie's

Michelin Man

Stupid Boring Gimmicks:

Baby

Hooker

Pimp

Doctor

Vampire

Witch

Crazy scientist

Pirate (jack sparrow)

Convict

Posted by TJ on Wednesday August 1, 2007 @ 05:08 PM

[Tags: news, guide]

It always amazes me how much news comes out of New York. It seems like 70% of the news stories I read from CNN or MSNBC seem to be from either NYC or some odd town in upstate NY. Well I decided to some "Goosearch" to help prove my hypothesis. First, lets define "Goosearch" as some of you may not know what it refers to (I just made it up): Goosearch is using the quantity of results for a specific phrase to prove the popularity or every day usage in culture of a term.

So lets start

All research was done using the Google News Search Engine (http://news.google.com)

Which state is the most newsworthy?

"New York" 388,538 results

"New Jersey" 46,400 results

"texas" 133,429 results

"California" 154,006 results

Florida 114,298

Wyoming 10,388

Looks like New York is the most news worthy state by far. New York had 100% more results than the California which was the nearest contender.

However, unlike many other state's New York's largest city, "New York City" also has the state's name in it so could this scewing results?

A search for all news articles including "New York" but not "New York City" returns 347,383 results, not significantly different for a search for just "New York"

See for yourself: http://news.google.com/news?hl=en&um=1&tab=wn&ie=UTF-8&q=%22new+york%22+-%22new+york+city%22

Is New York City the most popular city in the world?

Manhattan - 31,600 results

manhattan OR bronx OR queens OR Brooklyn - 60,554 results

New York city - 42,218

manhattan OR bronx OR queens OR Brooklyn OR "New York City" 90,820 results

[Tags: news, guide]

It always amazes me how much news comes out of New York. It seems like 70% of the news stories I read from CNN or MSNBC seem to be from either NYC or some odd town in upstate NY. Well I decided to some "Goosearch" to help prove my hypothesis. First, lets define "Goosearch" as some of you may not know what it refers to (I just made it up): Goosearch is using the quantity of results for a specific phrase to prove the popularity or every day usage in culture of a term.

So lets start

All research was done using the Google News Search Engine (http://news.google.com)

Which state is the most newsworthy?

"New York" 388,538 results

"New Jersey" 46,400 results

"texas" 133,429 results

"California" 154,006 results

Florida 114,298

Wyoming 10,388

Looks like New York is the most news worthy state by far. New York had 100% more results than the California which was the nearest contender.

However, unlike many other state's New York's largest city, "New York City" also has the state's name in it so could this scewing results?

A search for all news articles including "New York" but not "New York City" returns 347,383 results, not significantly different for a search for just "New York"

See for yourself: http://news.google.com/news?hl=en&um=1&tab=wn&ie=UTF-8&q=%22new+york%22+-%22new+york+city%22

Is New York City the most popular city in the world?

Manhattan - 31,600 results

manhattan OR bronx OR queens OR Brooklyn - 60,554 results

New York city - 42,218

manhattan OR bronx OR queens OR Brooklyn OR "New York City" 90,820 results

Posted by TJ on Wednesday July 25, 2007 @ 03:11 PM

[Tags: internet, software, guide]

I am going to do a reinstall of my computer and started making a list of all the programs I need to reinstall once I am ready. Not all of these I use as I added some programs I intend to use or other suggestions that may be useful for others but not for me.

Thanks to the SAforums and Steve for letting me know about these programs.

Paint.Net - a free Adobe Photoshop alternative

Firefox - better alternative to internet explorer

Gmail notifier - for gmail users, alerts you when you have new Gmail messages.

OpenOffice - replaces Miscrosoft Office

PuTTY - SSH and telnet

Rainlendar - a neat little desktop calendar

FileZilla - the full-featured FTP client

Process Explorer - - replacement for windows task manager

Startup Control Panel - Configure which programs run when your computer starts.

Startup Monitor - monitors changes to your startup program list

Thunderbird - email client, to replace outlook

GAIM - AIM without ads

ISORecorder - powertoy to burn CD and DVD images; create an ISO from any folder.

ckrename - batch file renamer

launchy - enter in the name of an application and it finds it.

Weather Watcher - Weather in your system tray - I do not use this program but this may useful for those looking for something like this.. as this one does not contain spyware/adware like most of them do.

Irfanview - Awesome image viewier (crop/resize/rotate)

Webmon - A program that will monitor a webpage and notify you when it changes

Dscaler For those who have a TV tuner installed this is the program to watch it with.

Security/Cleaners

Spybot S&D - Search and destroy adware and spyware from your computer

CCleaner - alternative to Windows Add/Remove, clean logs/cache's and temporary files

CORE FORCE R0.95 - replaces Windows Firewall

Avast! Antivirus - Best antivirus scan

Erasure - Deleting files in windows leaves traces left on your harddrive, this program really deletes those traces

Media Players

Media Classic Player - Light Weight DVD and media player

GOM Player - play media files

VLC Player - http://en.wikipedia.org/wiki/Comparison_of_media_players (same as GOM but not as nice interface)

Firefox Add-Ons

Web Developer Toolbar

FireBug

Adblock

Flashblock

NoScript

Steve, have any to add? (Other than Linux)

[Tags: internet, software, guide]

I am going to do a reinstall of my computer and started making a list of all the programs I need to reinstall once I am ready. Not all of these I use as I added some programs I intend to use or other suggestions that may be useful for others but not for me.

Thanks to the SAforums and Steve for letting me know about these programs.

Paint.Net - a free Adobe Photoshop alternative

Firefox - better alternative to internet explorer

Gmail notifier - for gmail users, alerts you when you have new Gmail messages.

OpenOffice - replaces Miscrosoft Office

PuTTY - SSH and telnet

Rainlendar - a neat little desktop calendar

FileZilla - the full-featured FTP client

Process Explorer - - replacement for windows task manager

Startup Control Panel - Configure which programs run when your computer starts.

Startup Monitor - monitors changes to your startup program list

Thunderbird - email client, to replace outlook

GAIM - AIM without ads

ISORecorder - powertoy to burn CD and DVD images; create an ISO from any folder.

ckrename - batch file renamer

launchy - enter in the name of an application and it finds it.

Weather Watcher - Weather in your system tray - I do not use this program but this may useful for those looking for something like this.. as this one does not contain spyware/adware like most of them do.

Irfanview - Awesome image viewier (crop/resize/rotate)

Webmon - A program that will monitor a webpage and notify you when it changes

Dscaler For those who have a TV tuner installed this is the program to watch it with.

Security/Cleaners

Spybot S&D - Search and destroy adware and spyware from your computer

CCleaner - alternative to Windows Add/Remove, clean logs/cache's and temporary files

CORE FORCE R0.95 - replaces Windows Firewall

Avast! Antivirus - Best antivirus scan

Erasure - Deleting files in windows leaves traces left on your harddrive, this program really deletes those traces

Media Players

Media Classic Player - Light Weight DVD and media player

GOM Player - play media files

VLC Player - http://en.wikipedia.org/wiki/Comparison_of_media_players (same as GOM but not as nice interface)

Firefox Add-Ons

Web Developer Toolbar

FireBug

Adblock

Flashblock

NoScript

Steve, have any to add? (Other than Linux)

Posted by TJ on Monday July 23, 2007 @ 04:04 PM

[Tags: taxes, guide, accounting]

Here is how your Taxes work out in a very summarized manner.

This formula should help resolve a couple misconceptions about your income tax including:

Misconception #1 All tax deductions are a direct deduction of my tax liability - This is not the case. Most tax deductions are 'above the line' deductions which means they reduce the amount of income subject to tax. A tax credit only reduces the amount of tax you pay dollar-to-dollar.

Misconception #2 Tax refunds are a good thing - not necessarily. A tax refund is an interest-free loan to the goverment. A tax refund does not reduce the tax you pay during the year it only effects the time you pay it. If you owe money at the end the year, this means, that you did not withhold enough from your paychex during the year, if you get a refund you withheld too much taxes during the year. If you are good with savings, a refund means that you lost out on the interest that refund would of earned had it been in your bank account the whole year.

Disclaimer: Any tax advice included in this written or electronic communication was not intended or written to be used, and it cannot be used by the taxpayer, for the purpose of avoiding any penalties that may be imposed on the taxpayer by any governmental taxing authority or agency.

[Tags: taxes, guide, accounting]

Here is how your Taxes work out in a very summarized manner.

+ Income Earnings from wages, dividends, interest, capital gains - Less: The greater of the Standard or Itemized Deductions Here's where you can deduct Medical, State Income and Property taxes, business expenses, and mortgage interest - Less Dependency Exemptions (in 2006 this was $3,300 per dependant) = Adjusted Gross Income (AGI) X Tax rate = Tax Liability - Less Tax Credits (Foreign tax credit, Child and dependant care expenses, education credit, child tax credit) - Less Withholdings during the year = Total Due (refund) |

This formula should help resolve a couple misconceptions about your income tax including:

Misconception #1 All tax deductions are a direct deduction of my tax liability - This is not the case. Most tax deductions are 'above the line' deductions which means they reduce the amount of income subject to tax. A tax credit only reduces the amount of tax you pay dollar-to-dollar.

Misconception #2 Tax refunds are a good thing - not necessarily. A tax refund is an interest-free loan to the goverment. A tax refund does not reduce the tax you pay during the year it only effects the time you pay it. If you owe money at the end the year, this means, that you did not withhold enough from your paychex during the year, if you get a refund you withheld too much taxes during the year. If you are good with savings, a refund means that you lost out on the interest that refund would of earned had it been in your bank account the whole year.

Disclaimer: Any tax advice included in this written or electronic communication was not intended or written to be used, and it cannot be used by the taxpayer, for the purpose of avoiding any penalties that may be imposed on the taxpayer by any governmental taxing authority or agency.

Posted by TJ on Wednesday July 18, 2007 @ 02:49 PM

[Tags: tv, opinion, guide]

Here is my take on the various Late Night Talk Shows.

I dedicate this to the late Tom Snyder who died on July 29, 2007 from complication with leukemia. Snyder was one of early pioneers of late night talk shows with "Tomorrow" in the 80's and 90's and was host of the CBS's The Late Late Show in 1990's.

CBS - The Late Show with Dave Letterman

I find Letterman extremely funny. Being from NY definitely makes his show even better to watch as he frequently does local stuff involving the city and surrounding area. Dave has a way of making ordinary people into comic geniuses as he has done with stage manager Biff Henderson, Handyman George Clark and Deli owner Rupert Jee, these sketches are what make the late show original and funny. What I do not like about the show is the numerous pointless unfunny skits that are done from time to time like "will it float?" , stump the band, and "Is this Anything", and most of Alan Kaulter's skits. Dave's show is well known for the Stupid Human Tricks and the Top Ten list.

NBC - The Tonight Show with Jay Leno

This is most watched late show and has surpassed the late show every year since the 90's. I am not sure why as I don't really find Jay funny. He gets old ripping on the band leader Kevin Eubanks. I find that the writers for the show aren't that good as his jokes often get no laughs and Leno is not that great with covering it up. His most popular feature is headlines on Monday and this a rip off of David Letterman's skit "Dumb Ads" that Dave introduced in the 80's. Yes that is right, Leno is actually ripping off Dave, not as you may have thought as Letterman re-introduced this skit under the name "Small Town News" in 2004 to compete with Leno's segment.

CBS - The Late Late Show with Craig Ferguson Craig's Gig is "Let's repeat the same sayings every episode that make people laugh" This is how a normal episode of CBS late late show goes. 1. Craig Ferguson enters saying to the audience "Enjoy the show, sit down , lay down...take off your pants." 2. Craig opens email bag tell audience to email him at "Craig@internet........com" 3. Craig Calls voice mail and pertains to dial 10,000 numbers just to get to his voice mail as if this demands laughter every single time. I do not know how people can watch his show every day with out getting annoyed at the amount of the stuff he repeats each day. I get tired of it after watching twice in a week. This show would be funny if it didn't have the repetitive crap.

NBC - Late Night with Conan O'Brien When I heard that O'brian was replacing Leno on the Late show in 10 years (less now) I was not that excited. Conan to me was the combination of "Let's act stupid and people will laugh" and "Lets make of fun of myself so people laugh". However Conan has some great monologue's and skits and they never get old.

Last Call with Carson Daly, NBC There is nothing much to say about this show. When I watch him he always look as if he doesn't even know why he's there, and with good reason. The show does not have much content and Carson is just so bleh. The only good thing about this show is it pulls in some good music talent.

The Daily Show with Jon Stewart, Comedy Central I think Jon Stewart is great and I'm not sure why but I do not watch his show much. I think a lot has to do with the fact his show is on Comedy central and not a major network. His show is more geared toward turning current news into humor and does a great job at it! I feel Stewart would make a great replacement for Letterman.

[Tags: tv, opinion, guide]

Here is my take on the various Late Night Talk Shows.

I dedicate this to the late Tom Snyder who died on July 29, 2007 from complication with leukemia. Snyder was one of early pioneers of late night talk shows with "Tomorrow" in the 80's and 90's and was host of the CBS's The Late Late Show in 1990's.

CBS - The Late Show with Dave Letterman

I find Letterman extremely funny. Being from NY definitely makes his show even better to watch as he frequently does local stuff involving the city and surrounding area. Dave has a way of making ordinary people into comic geniuses as he has done with stage manager Biff Henderson, Handyman George Clark and Deli owner Rupert Jee, these sketches are what make the late show original and funny. What I do not like about the show is the numerous pointless unfunny skits that are done from time to time like "will it float?" , stump the band, and "Is this Anything", and most of Alan Kaulter's skits. Dave's show is well known for the Stupid Human Tricks and the Top Ten list.

NBC - The Tonight Show with Jay Leno

This is most watched late show and has surpassed the late show every year since the 90's. I am not sure why as I don't really find Jay funny. He gets old ripping on the band leader Kevin Eubanks. I find that the writers for the show aren't that good as his jokes often get no laughs and Leno is not that great with covering it up. His most popular feature is headlines on Monday and this a rip off of David Letterman's skit "Dumb Ads" that Dave introduced in the 80's. Yes that is right, Leno is actually ripping off Dave, not as you may have thought as Letterman re-introduced this skit under the name "Small Town News" in 2004 to compete with Leno's segment.

CBS - The Late Late Show with Craig Ferguson Craig's Gig is "Let's repeat the same sayings every episode that make people laugh" This is how a normal episode of CBS late late show goes. 1. Craig Ferguson enters saying to the audience "Enjoy the show, sit down , lay down...take off your pants." 2. Craig opens email bag tell audience to email him at "Craig@internet........com" 3. Craig Calls voice mail and pertains to dial 10,000 numbers just to get to his voice mail as if this demands laughter every single time. I do not know how people can watch his show every day with out getting annoyed at the amount of the stuff he repeats each day. I get tired of it after watching twice in a week. This show would be funny if it didn't have the repetitive crap.

NBC - Late Night with Conan O'Brien When I heard that O'brian was replacing Leno on the Late show in 10 years (less now) I was not that excited. Conan to me was the combination of "Let's act stupid and people will laugh" and "Lets make of fun of myself so people laugh". However Conan has some great monologue's and skits and they never get old.

Last Call with Carson Daly, NBC There is nothing much to say about this show. When I watch him he always look as if he doesn't even know why he's there, and with good reason. The show does not have much content and Carson is just so bleh. The only good thing about this show is it pulls in some good music talent.

The Daily Show with Jon Stewart, Comedy Central I think Jon Stewart is great and I'm not sure why but I do not watch his show much. I think a lot has to do with the fact his show is on Comedy central and not a major network. His show is more geared toward turning current news into humor and does a great job at it! I feel Stewart would make a great replacement for Letterman.

RSS Feed

RSS Feed